Lubbock Central Appraisal District 2024 Reappraisal For Property Taxes

O'Connor completed an examination of Lubbock Central Appraisal District's 2024 Reappraisal for Property Taxes.

LUBBOCK , TEXAS , UNITED STATES , May 8, 2024 /EINPresswire.com/ -- Lubbock Central Appraisal District Facts

Apart from Potter and Randall counties, which share a single appraisal district, each county in Texas has its own. As of 2022, the Lubbock Central Appraisal District operates with an annual budget of $4.8 million, based on the latest available data. Their team of 23 appraisers handles the valuation of approximately 162,356 taxable properties.

Lubbock County Home Tax Reappraisals Increase Almost 7%

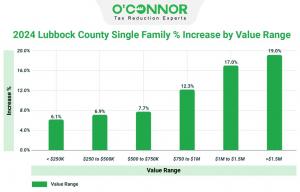

Lubbock Central Appraisal District boosted the assessed value of single-family residences by 7.3% in 2024. Property tax assessments increased the most in Lubbock County for residences worth more than $1.5 million, rising from $314 million to $374 million, representing a 19% rise in market value. Conversely, the lowest increase came in the value category for properties valued under $250,000, with a “minor” 6.1% increase.

The total value of all properties, irrespective of their size, rose from $21 million to $22 million, representing a 7.3% rise in 2024. Higher-value properties, namely those with an area of more than 8,000 sq ft, had a significant gain of 10%. The rise in property value for single-family homes in Lubbock County remained steady across all sizes of homes.

Lubbock Metro Single Family Value Appreciation Compared to Lubbock Assessment Increases

During the 2024 property tax reassessment in Lubbock County, the Lubbock Central Appraisal District reportedly raised home values by 7.3%. However, the actual increase in Lubbock Metro home prices from January 2023 to January 2024, as assessed by the Lubbock Association of Realtors, was -12.2%.

Lubbock County Tax Assessments Based on Year Built

In the 2024 property tax reappraisals conducted by the Lubbock Central Appraisal District, properties built before 1960 in Lubbock County seemed to have undergone greater assessments compared to residences built in other years. The assessed value rose from $3.5 billion to $3.9 billion, marking a 9.8% increase. Meanwhile, there was a tie in the lowest increase between homes built from 1961 to 1980 and those constructed from 1981 to 2000, both seeing a 4.5% rise. In summary, according to data from the Lubbock Central Appraisal District, house values by year built saw a collective 7% increase across the county.

In 2024, 52% of the homes in Lubbock County were overvalued by the Lubbock Central Appraisal District. The study is based on a comparison between the 2023 sales price of a home and the 2024 property tax reassessment value. In contrast, the 2024 sales price was lower than the value of 48% of the residences sold in 2023.

Lubbock County Commercial Owners Face Shocking Tax Revaluations!

In Lubbock County, several business property owners have challenged their property taxes in 2024. Quite a few property owners seem to have had significant increases in property value over the prior year. Commercial property values for land surged, escalating from $732 million to $1.5 billion, an extraordinary 112%. Retail proprietors increased at a surprisingly low rate at just 15.5%.

The Lubbock Central Appraisal District’s commercial property assessments for 2024 have risen, regardless of the year of construction. Commercial properties in Lubbock County labeled as “others” seem to be larger than any other construction year category of houses. This category had the greatest rise in value at 111.4%, indicating that no year of construction is documented in the tax account. Most tax accounts have construction year data accessible. The range with the lowest documented rise is residential property developed between 1961 and 1980, at 17.1%.

Disconnect Between a LCAD Values and Wall Street Bankers

There is a substantial discrepancy between the Wall Street company Green Street Real Estate company’s research and the Lubbock Central Appraisal District’s 2024 commercial property tax reassessment. Commercial property values increased by 33.5% over the previous year, according to the Lubbock Central Appraisal District.

Lubbock County Property Increase in Taxable Value by Value Range

For the 2024 tax year, Lubbock County’s commercial property assessments reflect a significant rise across all assessed value categories and value ranges. While properties above $5 million only grew by 21.1%, those priced between $500K and $1M had a jump of almost 56.1%.

Lubbock County Apartment Property Increase by Year Built

The collective 2024 property tax assessments for apartment buildings in Lubbock County experienced about a 20% growth. The greatest increase occurred in apartment buildings constructed prior to 1960, which rose by 50.8% in value from $26 million in 2023 to $39 million in 2024. The apartment buildings categorized as “others” experienced the least amount of appreciation in value, rising from $452k to $514k, or 13.5%. According to data, the tax account for the “others” category does not include the year of building.

Lubbock County Office Buildings Percentage Increase by Year Built

The Lubbock Central Appraisal District reports a 28% rise in property tax assessments for office buildings built between 2000 and above. The office buildings constructed before 1960 showed the lowest increase, 3.4%. For all year-built ranges, the total increase has been around 20%.

Lubbock CAD Retail Tax Assessments Up About 15%

. Retail property in Lubbock County has received an average increase in value of 15.5%. The retail buildings built between 1981 and 2000 had the most growth, with their value rising from $173 million in 2023 to $213 million in 2024, a 22.5% increase. The outlier is the value of retail buildings developed from 1961 to 1980, which remained unchanged from the previous year, with a 0% gain for this year.

Between 2023 and 2024, the property tax assessment for warehouse building owners in Lubbock County had a substantial average increase of 38.3%. Warehouse buildings built in Lubbock County after 2001 and above have seen a sharp increase in value. The valuation of these structures rose from $100 million to $154 million, indicating a gain of 53.2%. A comparable increase of 49.7% has been seen in the market value of warehouse buildings built before 1960.

Office Building 2024 Reassessment by Type in Lubbock County

In 2024, there was a rise in property tax assessments for two specific types of office buildings in Lubbock County. The growth in office buildings was far higher, with a jump of 23%, compared to medical office buildings, which only had a 14% increase. The whole assessment for 2024 has increased by around 21%, going up from close to $1.1 billion to over $1.3 billion.

2024 Apartments Property Tax Revaluation by Type

In Lubbock County, the property tax assessments for various kinds of apartment buildings went up in 2024. The largest increase was seen in small apartment accounts, which went from $5.6 million to $10.9 million, a 93% increase. The least amount increased was Garden Apartment, which went from $1.9 billion to $2.3 billion, a 21% increase.

2024 Retail Property Tax Revaluation by Type

In 2024, there was a rise in property tax evaluations for two out of the three retail property categories in Lubbock County. The community shopping centers saw the least significant increase, with a minor growth of 1.9%, which remained relatively consistent from 2023. The number of single tenant properties had a 24% surge, while neighborhood shopping center saw a 22% increase.

Lubbock CAD Warehouse Revaluations by Type

The Lubbock Central Appraisal District determined that the market values of three categories of warehouse property had a collective rise of 38%. A remarkable surge of 50.4% in the value of mini warehouse buildings was observed, rising from $133 million to $201 million. The office warehouse category saw the most minimal gain in property values, with an increase of just $25,997, equivalent to around a 0.9% rise.

Summary for Lubbock CAD 2024 Property Tax Revaluation

Property owners in Lubbock County are facing substantial hikes in property values for both residential and commercial properties. Lubbock County saw greater reported growth compared to the Lubbock metro region.

The profits in commercial real estate were substantial. The market trends for commercial real estate have been challenging for some and quite unpleasant for others. Many owners of commercial properties would likely acknowledge in confidential conversations that the value of their assets has declined in recent years. The increase in interest rates from 1.71% in January 2022 to 4.05% in January 2024 is partially responsible for this situation. It is also a consequence of relatively stable income trends coupled with substantial and continuous rises in casualty insurance and other operating expenses.

Appeal Your Property Values Each and Every Year

Property proprietors in Texas, particularly those in Lubbock County, possess a legal right and would be wise to contest the evaluated worth of their land. Residential and commercial property owners have the option to provide evidence throughout the appeal process to substantiate their assertion that the assessed value is excessive. Owners should strongly consider initiating an appeal or engaging the services of a property tax consulting organization, since most property tax protests yield favorable outcomes. O’Connor has extensive experience spanning five decades in advocating against the principles upheld by residential and commercial properties. Furthermore, O’Connor possesses the necessary resources to support their primary objective of enhancing the lives of property owners by effectively reducing taxes at a fair cost.

About O'Connor:

O’Connor is among the largest property tax consulting firms in the United States, providing residential property tax reduction services in Texas, Illinois, and Georgia, as well as commercial property tax reduction services across the United States. O’Connor’s team of professionals possess the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs more than 600 professionals worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™ . There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ + +1 713-375-4128

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

YouTube

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.